Since you’re saving money and spreading the cost, even expensive bikes are affordable through Cyclescheme. But what’s the limit?

You can get virtually any bike through Cyclescheme. It can be any brand, and you can be anywhere in the country. There are over 2,000 Cyclescheme retailers nationwide, and you can order in store, online, or through click-and-collect or brand direct services.

How you get your bike is up to you. You might draw up a shopping list with a Cyclescheme retailer, then request a certificate to spend with them for that exact amount. Or you can ‘decide later’ by applying for a certificate of any value, then choosing where and how to spend it.

How much can I spend with the cycle to work scheme? And can I get more than one bike?

The limit for any single application was historically £1,000, including VAT. Now, however, many employers are offering schemes without limits. They can do this thanks to an update of Government guidance and Cyclescheme's 'Freedom to ride' program. To check your employers’ limit, simply log in to the Cyclescheme site via our homepage or use our ‘search for your employer’ tool.

The scheme can be used for a bike, cycling accessories, or a combination of both. You could even get two bikes – to use at each end of a train journey, for example – so long as they didn’t total more than your certificate value. You would need to get both bikes from the same retailer though.

How Many Times Can I Use The Cycle to Work Scheme?

Once you’ve finished making salary sacrifice payments, you can have a second (or third or fourth…) bite of the cherry. There is no limit on how many times you use the scheme during your employment, but as you can only have one application per 12 month period, use it wisely!

Can I spend more than my employer’s limit with Cyclescheme?

If your employer does have a set limit, then you will need to choose a cycle to work package that costs up to this figure (you cannot add funds on top).

Most employers still offer a large enough limit that you can get some decent equipment.

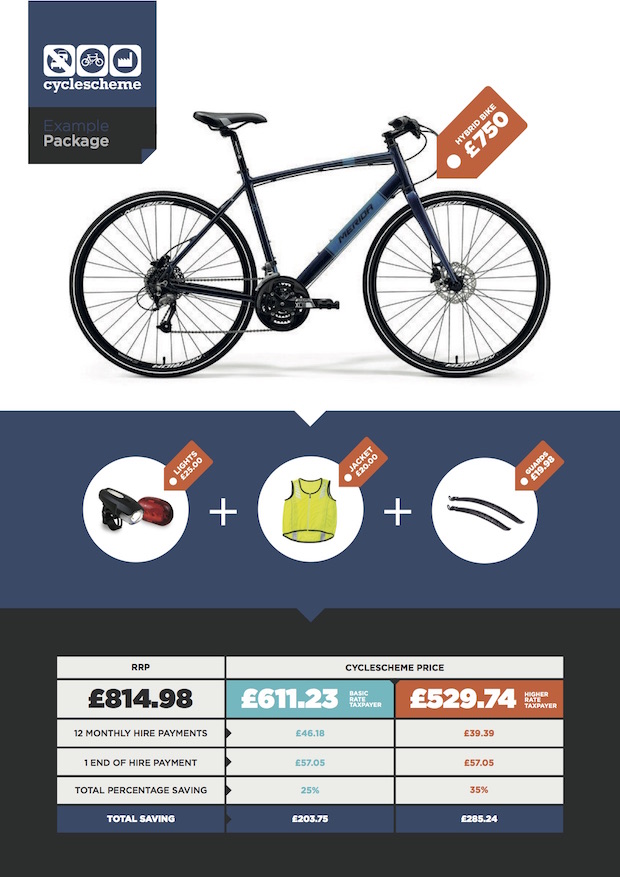

What savings can I make with Cyclescheme?

If you were a standard rate taxpayer, you could expect to save £250 through the reduction in your income tax and national insurance payments. So a £1,000 bike would end up costing you £750 (inclusive of an ownership fee) – a handsome saving. And don’t forget that the bulk of the cost would be spread over 12 months too.

Check your savings using our calculator.

Is there a minimum limit that my employer has to offer? And do I have to spend a certain amount?

While the vast majority of employers will offer 'Freedom to ride' – they are free to impose a lower limit, such as £500. Whether the limit is £10,000 or £500, you’re not obliged to spend up to it. You could get a bike costing only £300, for example. There’s no minimum value for a Cyclescheme certificate.

For some employees on lower salaries, the maximum value of their certificate may be less than the amount available to other employees. That’s because salary sacrifice payments cannot reduce anyone’s salary to less than the National Minimum Wage (NMW). They must still be earning at least the NMW after Cycle to Work deductions.

Comments: